Shopify Markets: Evaluating Currency Converter Apps in 2025

This article explores the limitations of currency converters and how to deal effectively with local currencies in Shopify Markets. We'll demonstrate why currency converters are no longer the best option by comparing their user experience with that of Shopify Markets. From providing an in-depth understanding of local currencies to illustrating practical examples, we cover everything you need to know.

Despite the availability of Shopify Markets, some merchants are still searching for the best currency converter apps. However, with the advent of Shopify Markets, is it still imperative to rely on external currency converter apps for localizing shopping experiences in Shopify?

To begin with, what exactly is Shopify Markets? According to Shopify:

Shopify Markets is a cross-border management tool that helps you identify, set up, launch, optimize, and manage your international markets - all from a single store.

Launched in August 2021, this innovative feature has transformed how Shopify brands approach localization. This sophisticated tool empowers you to personalize your content, product offerings, prices, currencies, languages, and much more, thereby localizing your shopping experiences in different countries or markets with ease.

As you already know, Shopify Markets enables you to sell products in local currencies. So, how does this affect currency converter apps when it comes to Shopify's ability to change currency based on location?

This article explores the limitations of currency converters and how to deal effectively with local currencies in Shopify Markets. We'll demonstrate why currency converters are no longer the best option by comparing their user experience with that of Shopify Markets. From providing an in-depth understanding of local currencies to illustrating practical examples, we cover everything you need to know.

So, let's get started!

Why Were Currency Converters Useful Before Shopify Markets?

It's no secret that international shoppers prefer to browse and buy products in their own currency and prices. In fact, according to Shopify, 92% of international visitors prefer this.

Before September 2021, selling in a different currency in the same store wasn't an option for Shopify merchants. Currency converters were a partial solution, as they offered a price estimate in the customer's currency on the product page. However, the checkout process still required payment in the store's primary currency.

For example, if a European customer visited a shop based in the US, they would see estimated prices in Euros on the product page but be charged in USD during checkout.

However, with the introduction of Shopify Markets, activating local currency is now easier than ever. With just a few clicks, brands can enable this option, and customers can see prices in their local currency - such as Euros - and pay in it too.

Could Brands Sell in a Different Currency Without Currency Converters Before the Introduction of Shopify Markets?

Before the introduction of Shopify Markets, brands could set up another Expansion Store and select a different currency as the primary. However, managing multiple stores can be expensive operationally, making it more feasible for brands with considerable volumes in other countries. This limitation made it difficult for many brands to expand globally.

If you are interested in learning more about managing multiple Shopify stores, check out this article on our blog.

How to Enable Local Currency Payments?

If you have Shopify Markets and Shopify Payments available in your country, you can activate local currencies directly from your Markets settings in a few simple steps. You can even decide to enable local currencies in some markets and sell in your primary currency in others, giving you more control over your global sales expansion strategy.

Why Aren't Currency Converters Needed with Shopify Markets?

Shopify Markets provides a simple way for brands to offer local currencies to customers worldwide. Using Shopify Payments, brands can natively display local currencies for their products without needing currency converters. The conversion process is automatically handled by Shopify Payments, resulting in a seamless purchasing experience for customers using their preferred currency.

On the other hand, relying solely on currency converters can result in a subpar localized experience for customers since they still pay in the brand's primary currency. By enabling local currencies in Shopify Markets, brands can provide a better user experience for their customers and improve sales in international markets.

What is the user experience like when using a currency converter?

Enabling local currencies in Shopify Markets restricts customers to making purchases solely in the designated currency for their country. Unlike currency converters, this ensures a consistent customer experience on the product detail page without the currency switching back to the brand's primary currency during checkout.

How Does Shopify Calculate Payments for Sales in Local Currencies?

Shopify processes payments for sales made in local currencies by converting the sale amount to your primary currency at the time of the transaction. This currency conversion occurs when you capture a payment, issue a refund, or experience a chargeback.

It's important to note that Shopify only pays sellers in their primary currency. So, if your store is based in the United States and you sell a product in Euros, Shopify will convert the sale amount to US Dollars at the time of the transaction and pay you in US Dollars.

The foreign exchange rate used for currency conversions is always the market rate at the time of the transaction, which means that these rates always fluctuate. Shopify automatically converts your online store prices to your customer's currency using market exchange rates. If you prefer more control over pricing, you can also manually set the currency exchange rate for each of your markets to provide stability and consistency for your customers.

For further information on payment calculations for sales in local currencies, we recommend checking out Shopify's Help Center for the most updated information.

Does Shopify change currency based on location?

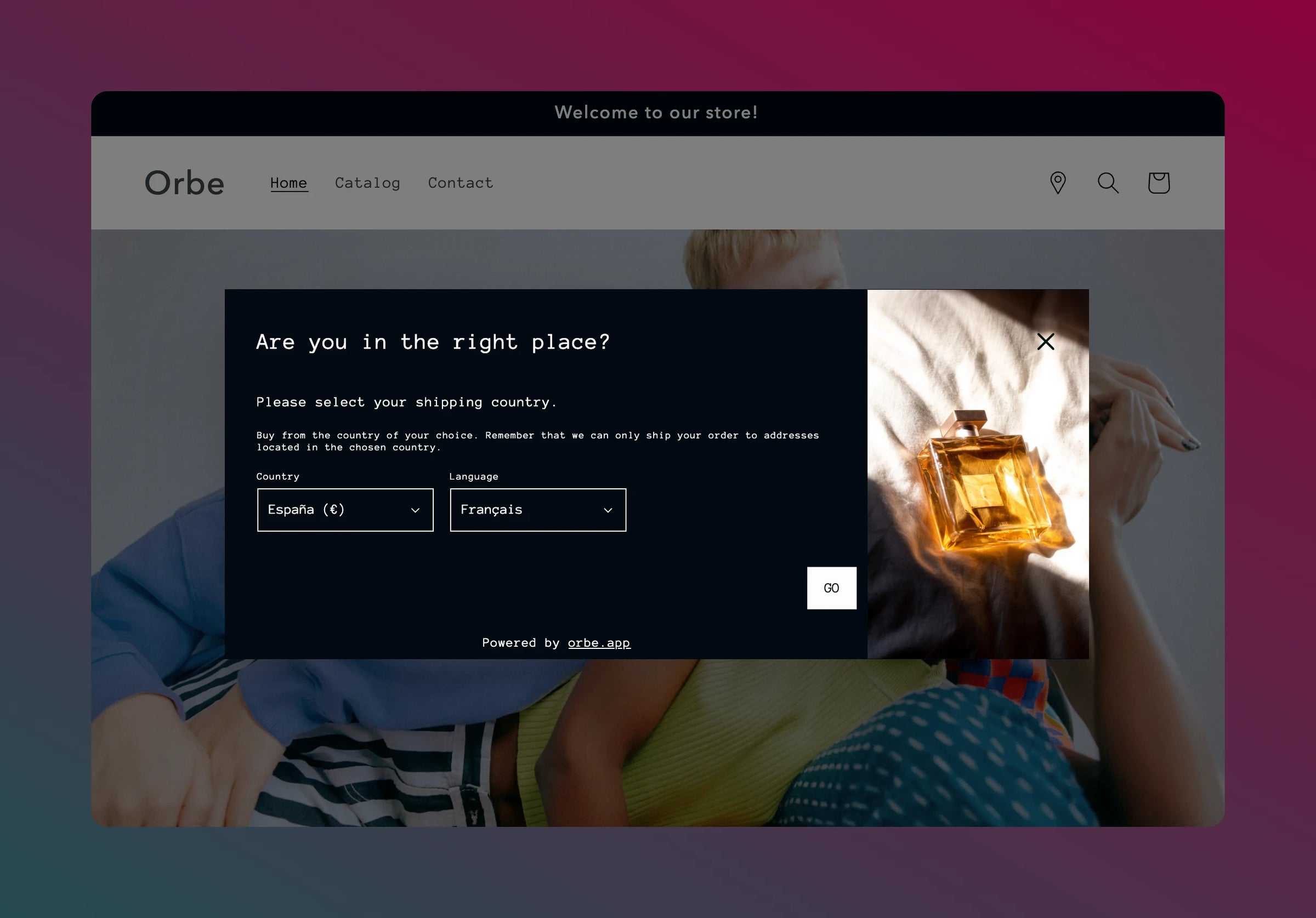

While Shopify Markets allow you to set local currencies in your store, they do not automatically change currencies based on location. To ensure that your customers see the correct prices and currency when using Shopify Markets, we recommend using Orbe.

Orbe, a customizable popup will recommend the right experience to your users depending on their IP address, respecting data protection laws, and utilizing SEO features to improve your online positioning. By leveraging Orbe, you can significantly increase your global conversion rates and retain international customers.

To gain a better understanding of how automatic redirection works on Shopify, we suggest reading our blog article dedicated to this topic. It provides comprehensive insights into the differences and can help you make an informed decision.

FAQ

What is the best currency converter app for Shopify?

Using Shopify Markets and enabling local currencies eliminates the need for currency converter apps on Shopify. While currency converters may have made sense in the past, the recent developments in Shopify's payment system have made them redundant and unnecessary. Activating local currencies within Shopify Markets allows sellers to receive payments in their primary currency while also allowing customers to pay in their preferred currency. This eliminates the need for third-party currency conversion providers and any associated fees.

So, if you are planning to launch international experiences, you no longer need to worry about finding the best currency converter app for Shopify. Simply enable local currencies within Shopify Markets and use Shopify Payments to streamline the purchasing experience for your customers.

What is the maximum number of currencies that can be displayed in each country?

In each country, it is only possible to sell in one currency. For example, if your store's primary currency is USD and you sell in the UK, in this country, you can choose to display prices in USD or show the local currency of GBP. Your customers won't be able to purchase items in other currencies like Euros or Yen, and will only be able to buy in GBP.

How can I receive payments in a different currency from Shopify?

If you have a significant volume of sales from a country with a different currency, you may find it beneficial to receive payments in that currency to avoid the exchange rate applied by Shopify. In this case, the only option is to open a Shopify Plus Expansion store and set the other currency as the primary currency. This will allow you to receive payments in the desired currency and avoid any additional fees incurred by the exchange rate.

For comprehensive insights into Shopify Plus Expansion stores, we highly recommend exploring this other article for further information.

When do you recommend using a currency converter app to change currencies?

We only recommend evaluating a currency converter app to change currencies in the following scenarios:

- If the country where your company is based still doesn't accept Shopify Payments. So, you cannot activate local currencies.

- If you don't have an Expansion Store or have already dismissed the idea of having one. It's important to note that if you open an expansion store in a country where Shopify Payments are available, you can natively activate local currencies and sell abroad using that store.

In these situations, a currency converter app can help you display prices in the local currency, allowing customers to see and browse products more conveniently. However, it's important to remember that using a currency converter app does not enable customers actually to pay in their local currency. They will still be required to make the payment in your store's primary currency, which may not provide the optimal user experience.

After considering the various factors involved with enabling local currencies on Shopify Markets, we conclude that, using currency converters with the combination of Shopify Markets and Shopify Payments will not be necessary. This is because activating local currencies within Shopify Markets allows for a streamlined customer purchasing experience by providing them with familiar pricing options. By using Shopify Payments, sellers can receive payments in their primary currency while also allowing customers to pay in their preferred currency. This eliminates the need for third-party currency conversion providers and any associated fees.

Overall, it is clear that Shopify is committed to providing a seamless and user-friendly experience for sellers and customers. By utilizing the features available within Shopify Markets and Shopify Payments, sellers can rest assured that they are providing their customers with the best possible purchasing experience.